JET Accounting Corrections

Accounting Corrections

It is very important to choose the correct journal category to allow for review of the JE categories as part of the post audit review process, which will be performed by both internal and external auditors. The four correction categories are:

CORRECTIONS-A/P: Use for corrections where the original transaction to correct is an invoice paid through a Purchase Order or a Payment Request Form/DirectPayment Form. This also includes student travel, reimbursements, or other items turned in on paper and keyed into Oracle by the AP office. Includes reallocations of AP payments. Includes corrections to AP credit memos.

CORRECTIONS-INTERNAL BILL: Use for corrections where the original transaction to correct is an Internal Billing. Also use for allocations/reallocations using 48XXXX or 78XXXX. This category is for object codes 48XXXX and/or 78XXXX only where the last four digits of the object codes balance to zero.

CORRECTIONS-OTHER: Use for corrections where the original transaction to correct is a Mail Interface transaction (not charged with IC codes), SIS Peoplesoft transaction, Suspense account corrections for Transact Payments, SIS Peoplesoft and Mail, and Receivables including AR Sales Invoices, AR Credit Memos and AR Misc Receipts. For recurring SIS Peoplesoft entries, email bursar@ohio.edu to update account information for future transactions. For recurring Transact Payments or eMarket entries, email cashier@ohio.edu to update account information for future transactions. NOTE: This journal category should be used infrequently. Use this category for corrections only if no other correction journal category is appropriate.

CORRECTIONS-PCARD/CONCUR: Use for corrections where the original transaction to correct was paid by a PCard transaction or CTA Card transaction and other items entered in Concur including TR - travel expense reports and RE - other reimbursements.

Note: For corrections to paper TR's use the Journal Category- 'Corrections-A/P'. For Payroll corrections, do not create a Journal Entry. Fill out a Payroll Expense Accounting Corrections (PEDS) Form & follow email instructions on the form.

Making the Entry in JET

Correction Journals will require an original GL Transaction date for GL entries or Grants Expenditure Item Date and Original PA Date for Grants entries as well as a 90 Day Correction Reason, if the original transaction's effective date for GL entries or the Original PA Date for Grants entries is more than 90 days prior to the correction.

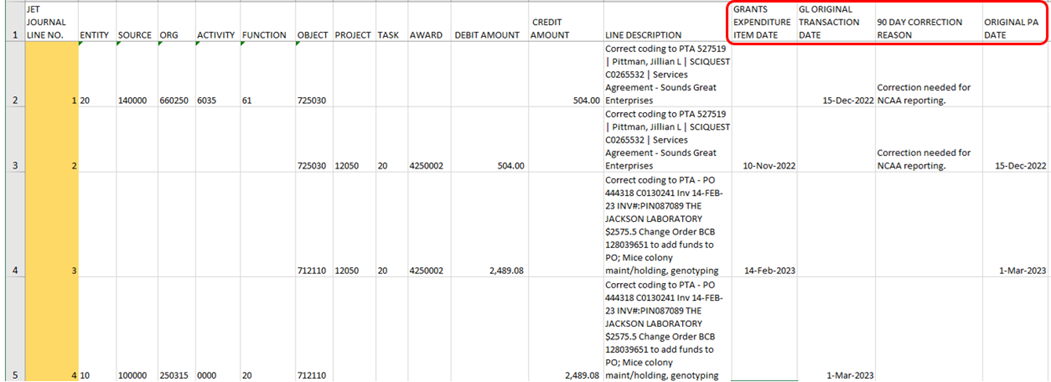

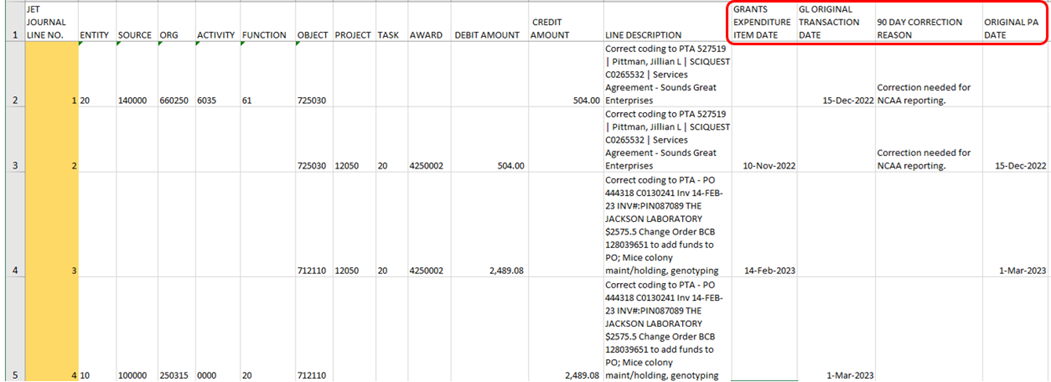

The entry below is an A/P Correction entry. Note that either the GL Original Transaction Date or the Original PA Date field is populated for all lines and that the Grants Expenditure Item Date field is populated for Grant entry lines. Note also that a 90 Day Correction Reason is given for the correction of transactions that are over 90 days.

Additional information on viewing general ledger or grants transactions and accounting corrections for transactions over 90 days, in OBI.

90 Day Rule Requirements

Accounts should be reviewed monthly, so corrections for transactions that are over 90 days old should be very infrequent. These transactions will be reviewed by Central Accounting and will be reversed if an invalid 90 Day Correction Reason is given.

The 90 day correction reason must include:

1) What unusual circumstances exist that justify exception to the 90 day rule?

2) What action will be taken to eliminate future corrections?

Additional information on over 90 day accounting corrections